Welcome to the information page about our employee benefits and pension at Visma e-conomic.

On this page you can find all information about the benefits, seek specific knowledge and book a personal session if you need a new review of your pension plan and benefits.

Ensure Pension is our insurance and benefits broker and supports Visma e-conomic and our employees with independent advice and counseling.

Hurtige links

- Pension scheme in Danica

- Get an overview of your pension scheme

- Investing your pension funds

- Your health insurance

- Need treatment?

- Co-insurance for your family

- Health-promoting initiatives in one solution

- Special advice for those aged 58+

- Independent advice at Ensure

- Book a meeting

- Your Ensure contact person

Pension scheme in Danica

Danica Pension is a subsidiary of the Danske Bank group and is one of Denmark’s largest pension companies.

You can read more about Danica Pension here.

With the pension scheme in Danica, we have, among other things:

- the market’s most competitive pricing on administration and investment costs as well as on our insurance package.

- discount on investment costs in Danica Balance and Danica Link of 0.4%

- great variety in the product range of the insurance package and investment with the option of individual adaptation as well as sustainable investment.

- historical return performance that make it a market leader.

- market-compliant IT platform.

- personal support to navigate through the healthcare system and the local authority if you need help in connection with a long-term illness.

- access to targeted input by specialists – both physical and psychological – if you are on sick leave. Including preventive measures.

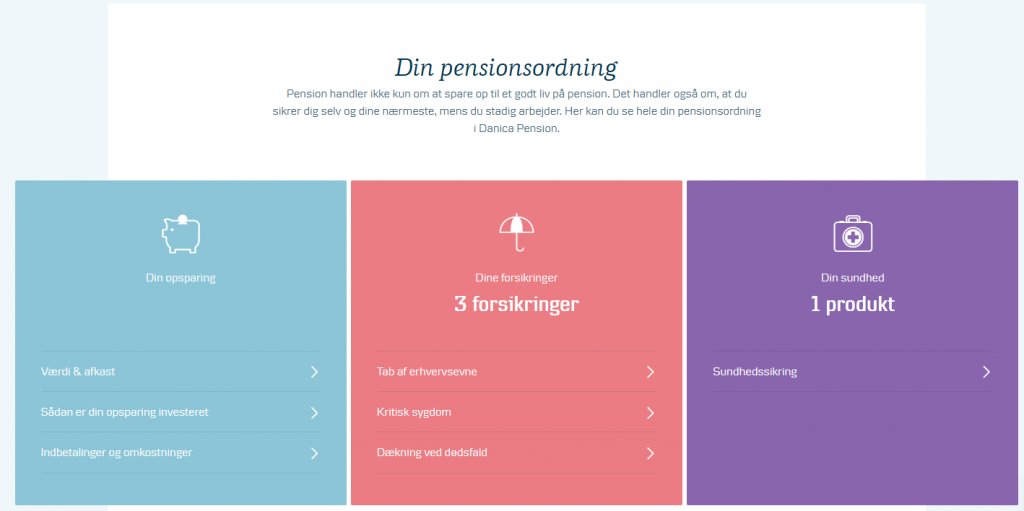

In addition to pension savings, the scheme also includes a number of insurance covers should an accident occur. The insurance covers apply to you up to retirement age and you can adapt them to your individual needs:

| Reduced work capacity | Danica Salary Scheme – option to choose between 30-80% of annual salary |

| Certain critical illnesses | DKK 175,600, option to choose DKK 317,600, DKK 573,100 or DKK 722,500. |

| Death cover | 100% of annual salary, option to choose between 100-800% of annual salary |

| Children’s pension | 0 – 25 % of annual salary |

Get an overview of your pension scheme

You can get a complete overview of your individual pension scheme here:

Just as you can also use Danica’s app, which provides an easy and simple overview:

For international employees – pension plan option without tax deduction

If you are an international employee, you have the alternative to obtain a pension plan without tax deduction (§53A)

You can read more about the possibility and the differences between a pension plan with or without tax deduction in the attached flyer: Read more here.

Investing your pension funds

Danica has a wide variety of products and a broad range of different savings products.

Our broker and advisor in Ensure will help you choose the right strategy and investment plan for your pension funds. Your pension scheme is pre-selected with the investment product Danica Balance Mix Medium risk.

There are also quite a few other investment products that you can browse by clicking the button below.

Your health insurance

Danica helps to find the best treatment, for example with a psychologist, physiotherapist or chiropractor. You also have access to private hospitals, so you avoid long waiting lists.

Do you need treatment?

When you need treatment, you must report directly to Danica. You can see a quick guide to your online review here (In English from page 5).

Co-insurance for your family

Your children (up to the age of 24) are covered by health insurance in Danica. You have the opportunity to register your spouse/partner here.

Health-promoting and preventive initiatives in one integrated solution

We want to target our preventive efforts and shift the focus from symptom treatment to lasting help and prevention for the benefit of you and your well-being. By pooling the skills and ensuring good cooperation across our offer, we believe that we can offer a more effective handling and treatment of both physical and psychological challenges.

Together with relevant competencies from both Danica and Ensure, we continuously discuss the general state of health in the Visma group with a view to implementing relevant measures.

Special advice for those aged 58+

Take advantage of the opportunity as a 58+ year old at Visma E-conomic and get a payment plan that gives you a total overview and optimises your total pension payments. Paid via the pension deposit, whereby your real expenditure will only be approx. half due to tax deduction.

Independent advice at Ensure

To ensure a high-quality and impartial approach to advice, we work with Ensure on all aspects of our insurance, pension and health solutions.

Ensure is an insurance and pension broker and supports Visma in negotiating the best terms in the market but Ensure also helps you in your individual choices regarding your pension plan.

You can read more about Ensure on their website.

Book a session with Ensure

If you have any general questions, please contact our customer service at +45 51 95 50 00.

If you need a more in-depth discussion, you can book a 30-minute consultation. Simply use the link below to provide relevant information that will form the basis of your consultation and then book your appointment directly through our booking system.